From Single Cell to Salamander ( Time-Lapse )

Randy – The Life of Ernest Hemingway

Boring Silent Films

Automation

Cryptobaker or Snale-Rehydrator sound like awesome jobs

lol spd

flip

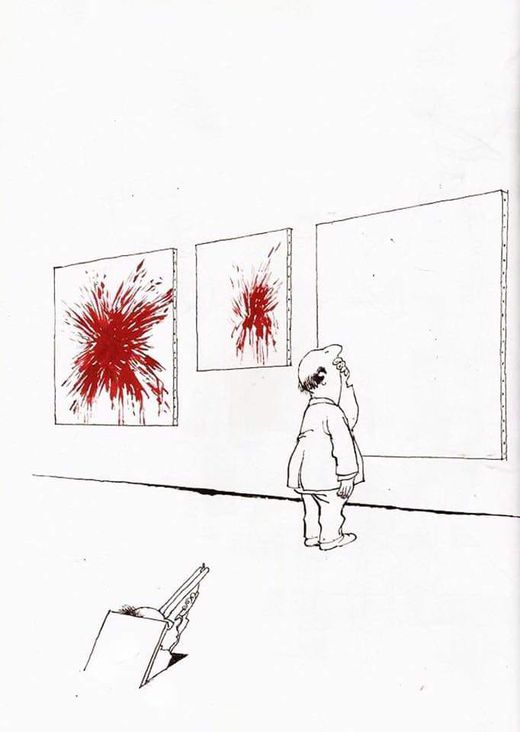

Stummfilmfestival Karlsruhe

Karlsruhe is hosting a silent movie festival.

Sadly, it seems, they won’t play any comedy this year.

I would love to see some Buster Keaton or Chaplin on the big screen 🙂

hmmm

Here comes trouble…

Jurassic 5

Still the same with a little fame ….

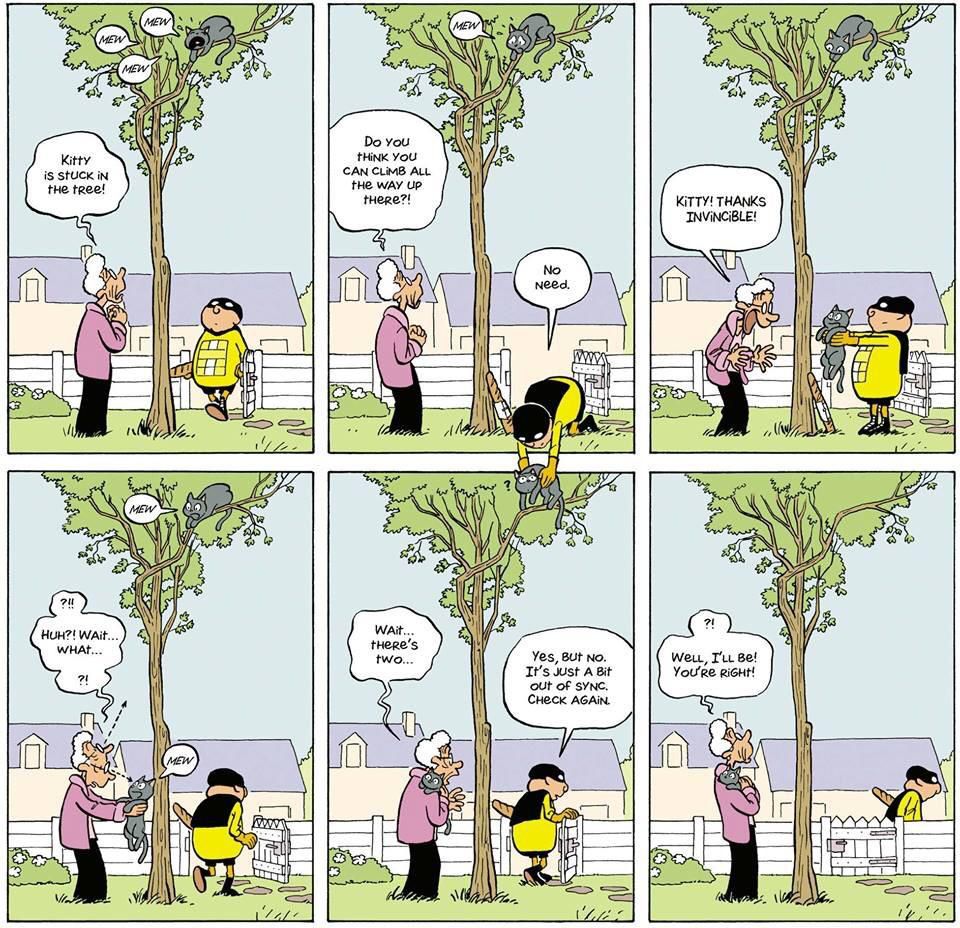

Kitty

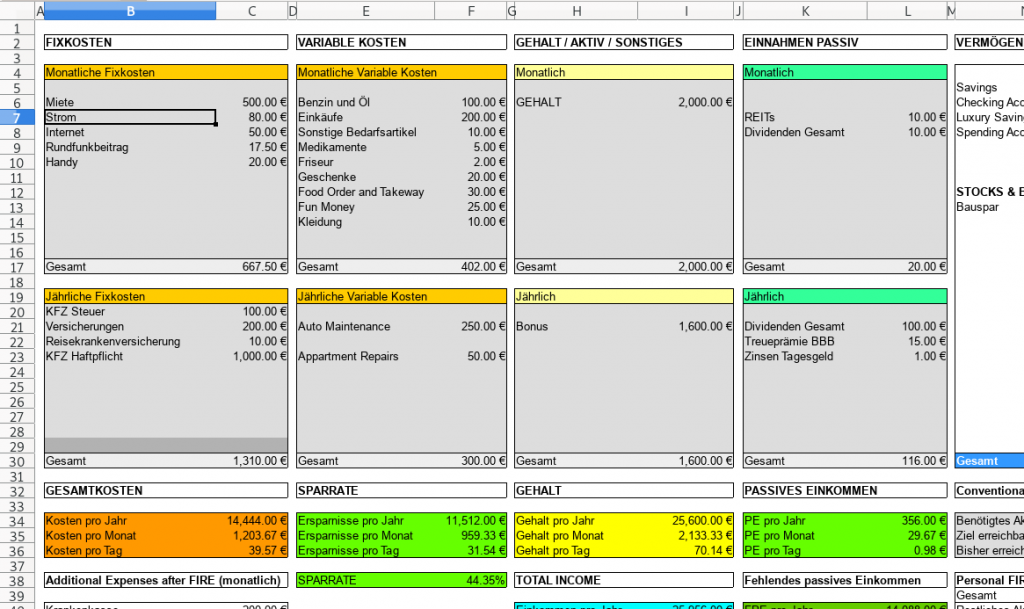

Personal Finance Story

STORY TIME !

Getting My Shit Together With Regards To My Finances

GO FROM ZERO TO HERO WITH YOUR FINANCES.

I’m doing a serious blog post now, serious blog posts are cool.

I have the weirdest hobbies sometimes. I get hooked on topics and can’t focus on anything else for months and months. It was the year 2017 and I decided I needed to to something productive for a change 🙂 …

I wanted to improve my finances. I had a decent salary at the time, but I noticed I was throwing the money out of the window as fast as it was coming into my bank account. Something needed to change. Little did I know, I will get hooked in the coming months.

I still have the checklist from two years ago.

- research apps and tools.

- move everything to online banking.

- get an overview of my subscriptions and bills

- kill some subscriptions

- use less power

- do your taxes

- look into investing

That was the idea.

Well it has been two years and I’m hooked on finances and economics.

Oh yeah and I’m totally aware that this sounds boring as hell. But you might wanna read what I have to say if you are in the same position I was about 2 years ago.

All of a sudden I started saving a little money here and there. Start saving for retirement is always a good idea. I was already contributing to Riester and decided to put additional money into an ETF savings plan. Time for an online broker account.

About the same time the 2017 crypto craze started to unfold. Everybody and your Grandma was buying Bitcoin… and so was I.

Looking back now, I know that crypto is the most risky and most insane way to “invest your money”… if you can even call it that. I gambled… I won … I gambled again … I lost… But after all the up and down, I made a little profit.

The important thing here is that Cryptocurrencies got me into economics and markets. One day you are sitting there buying some Ether and Bitcoin. The next day you are reading Whitepapers, Market analysis and listening to Andreas Antonopoulus talk about the future of money. You loose your mind and get greedy and suddenly you talk about the collapse of the world wide banking system and think cryptocurrencies are the answer. I’m exaggerating here but this was the spark that initial got me into topics about the global economy, the banking system, how money works and how to keep your cool if the market tanks. I wouldn’t miss it for the world. It’s easy to spot the top of a bubble in hindsight but it’s a whole different thing to expirience a financial bubble from a front row seat with some skin in the game until you panic sell. Fun times. I learned a lot of stuff, which will probably come in handy in future investments, risks and crisis.

But enough about crypto, we all know the one and only global currency will be dogecoin.

At the end of 2017 I was thinking of optimizing my finances to squeeze more out of my paycheck. It was fun putting money into stocks and crypto. So I wanted to learn more. At this time I started to read financial blogs, articles and subscribed to a ton of youtube channels.

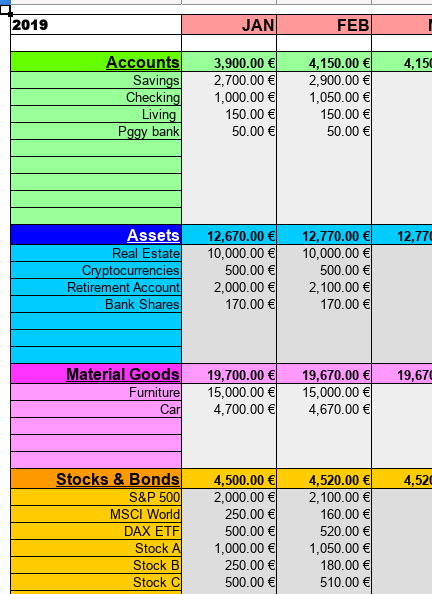

I started using multiple bank accounts and would add even more later on to seperate different categories. This helped a lot. I used one account for my living expenses, which had a fixed amount of money coming in every month.

- Savings Account ( Investment and Emergency Buffer )

- Checking Account ( Bills and fixed costs )

- Luxury Savings ( For big things like a new computer or vacations )

- Living ( This gets 400€ a month for gas, groceries, clothes )

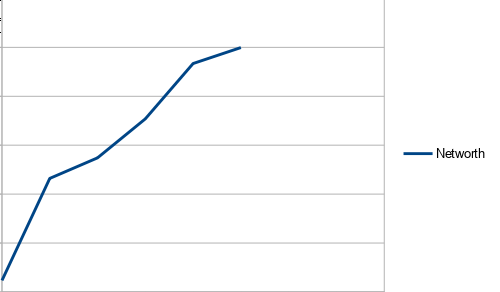

I also started tracking my networth which increased by about 30% in the first few months just by knowing where my money goes.

I made a nice little spreadsheet with fancy colors.

These are fake numbers of course…

You can download the ODS template here : Networth_Template

Sorry I only do libreoffice 🙂

Some people don’t want to add furniture and material goods into their networth. I like to add it in, because I can track if money is flowing into material things and I can see how the stuff I bought is depreciating over the years. Nobody cares anyway it’s just for yourself anyway. Add in whatever you like 🙂

As I saw my networth increase and my investments accumulate some more, I was thinking of ways to further improve my situation and there basically was one thing I haven’t tried yet… doing a budget and tracking every penny.

A lot of work? for sure.

Boring? hell yes.

tedious? probably.

Is there an app for that? tons.

This is when I started using YNAB . Ynab is awesome, It makes budgeting actually fun. Trust me. It’s a zero sum budget. So you give every dollar a job. It’s pretty intuitive and easy to learn. Way better than managing a shitload of excel spreadsheets. And the mobile app makes it possible to enter transactions on the go.

Who would have thought that budgeting can be fun. I for one sure wasn’t prepared for that. Paying for YNAB was worth while. In the first half year of using YNAB I increased my Networth another 31%. I saved so much money, I couldn’t believe it.

What now? I have ticked all the boxes for personal finances, I learned all about Investing, Stocks and Markets. I’m doing a budget. What is the next step, aside from increasing your salary… You might have guessed it.

The FIRE Movement. When you are always looking for ressources and tips to improve your finances, you will eventually end up with the guys and gals of the FIRE movement. It means Financial Independence / Retire early. The most known guy is probably Mr. Money Mustache, but there are bloggers popping up all over the place.

The movement is getting a foothold in germany as well, called Frugalismus.

These guys have some radical ideas on how to save money and achieve retirement at an early age. The basic math says you need about 25 times your anual expenses in Investments to retire. At that point you can take out 4% every year, without depleting your investment.

(Fake Numbers)

So I crunched the numbers and did the math. And it really is quite simple. If you squish your expenses down and save more you might have the chance to reach financial indepence. It’s also quite fun. Let’s wait and see how I’m doing in a year or so. It is really interesting to shuffle the numbers arround and see how to get the most out of your money. I created a nice FIRE Calculator in Libre Office, but it’s not quite finished yet.

Back in 2017 I never would have thought I will get hooked on financial topics and save that much. It’s actually a fun hobby instead of a chore now.

So to sum it all up and if you want to get a grip of your finances :

- lower your expenses step by step

- use multiple bank accounts

- live of a certain fixed amount you grant yourself each month

- use online banking / put everything on autopay

- pay yourself first ( obviously)

- Learn to Invest

- Start Investing in small amounts

- Do a budget ( seriously it works )

- Once you are on track it snowballs

- Don’t be afraid to take some risks

I plan to do some future blogpost to go more into detail.

cheers….

ISPs Violate the Laws of Mathematics

2035

I understand

guess who’s back …

Microservices

Portal Gun

The Silence of the Lambs — Dissecting a Scene

Hydration Cylinder

Game “Room”

Holy Shit !

in 150 Jahren

Toast

Jamaica’s up-and-coming talent 🙂

big up !

Changing Horror

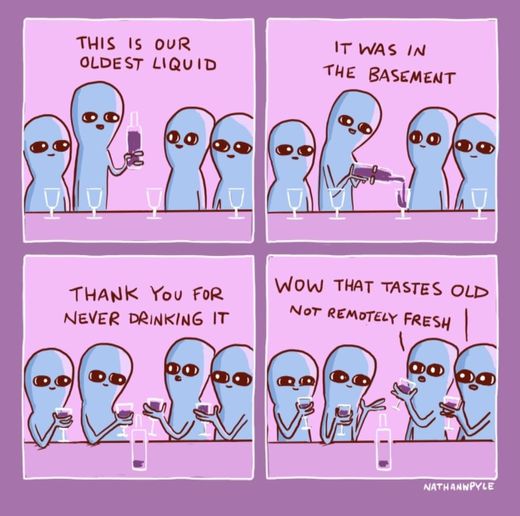

Old Liquid